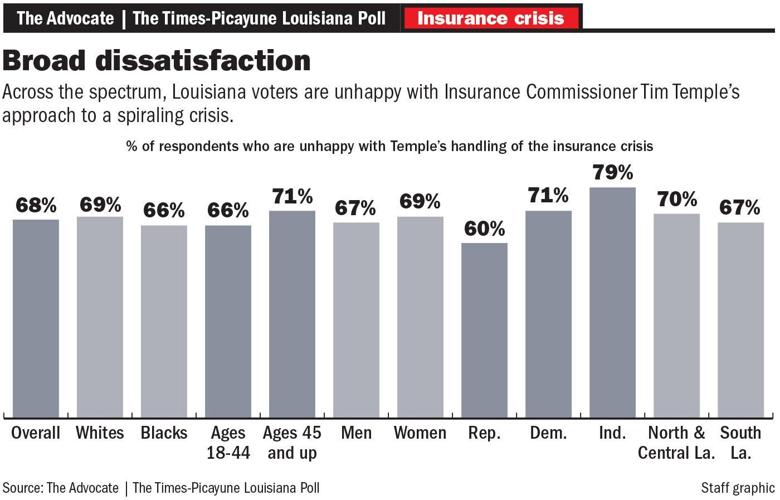

Louisiana voters, unhappy with a property insurance crisis that has caused intense rate hikes, are broadly dissatisfied with Gov. Jeff Landry and Insurance Commissioner Tim Temple’s handling of the issue, according to a statewide poll conducted for the Times-Picayune | The Advocate.

The poll reflects an enduring angst Louisianans feel about property insurance, which has become dramatically more expensive after a dozen insurers went bust following the 2020 and 2021 hurricane seasons and a number of others fled the state. The poll surveyed 800 voters around the state, primarily by cell phone, from April 22-26. It has a margin of error of 3.5%.

The results point to a political problem for Landry and Temple, both Republicans who took office in January. While Landry enjoys high approval ratings on most issues the poll covered, voters disapproved of his handling of insurance by a net 39 points, a notable outlier in the poll.

For Temple, who took office in January after running unopposed, the problem may be more dire. The poll found that he is unknown to many voters, and that he is underwater with the ones who do know him – perhaps because they associate him with a crisis. Only 21% have a favorable opinion of Temple, while 28% have an unfavorable view.

“It’s an issue that I think the voters are very upset about,” said pollster Ron Faucheux. “When they have an opportunity to state an opinion, it’s pretty negative toward what’s going on. It was by far the biggest negative that the governor has right now.”

The poll comes just after the Legislature passed a sweeping package of bills championed by Temple that would allow insurers to drop policyholders and raise rates more easily, among other things.

Temple, a former insurance executive whose strategy has been endorsed by the insurance industry, argues the effort will attract more insurers to the state, and that the resulting competition will drive down rates. He has remained confident the plan will work, and has encouraged people to blame him if it doesn’t.

"Louisianans are clearly frustrated by the poor property and auto insurance markets they’ve had to deal with for years now," Temple said Monday in response to the poll's findings. "I’m frustrated, too. That’s why I’m focused on solutions that will help Louisiana families and businesses by addressing the availability and affordability of insurance in our state."

Several of the bills are awaiting the signature of Landry, which is expected. Landry's office didn't respond to an email seeking comment.

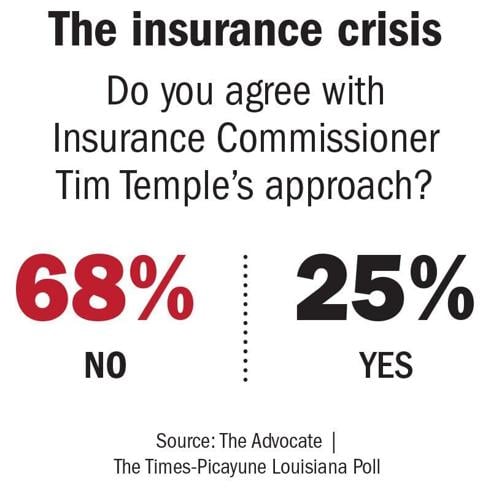

The poll results may reflect voters’ basic frustration with the cost of insurance as much as they reflect policy disagreements with Landry and Temple. But to the extent voters are familiar with Temple or his strategy, they tend to disagree with it. Asked about one key change Temple pushed – eliminating a longstanding and unique rule barring insurers from dropping policyholders after three years – 68% of voters said they disagreed with it.

Even if Temple’s plan to foster competition does work, it could take years for homeowners to feel the effects. Even then, some analysts believe Louisiana will likely continue to see relatively high rates because of rising climate risks.

Landry and Temple both took office in January, meaning they’ve had little time to enact changes that could improve the tumultuous insurance market, which has seen years of rate hikes.

Temple wanted Landry to call the Legislature into a special session to take on insurance shortly after the two were sworn in. But the governor has not made insurance a top issue, and instead held special sessions on redistricting and crime.

Voters appear dissatisfied with Landry’s efforts so far: Those polled said they disapprove of his handling of the insurance issue by a 60%-21% margin.

Not surprisingly, perhaps, the poll found a geographic split, with people in coastal South Louisiana far more perturbed about insurance than those in Central and North Louisiana. It was the No. 1 issue for 23% of those polled in South Louisiana, compared to 13% in the rest of the state.

Kimberly Powell, who has lived in a townhome in Baton Rouge for 12 years, said her premiums have skyrocketed, squeezing her finances. Her friends in New Orleans are in the same boat, and she said people are being priced out of living in Louisiana generally.

Insurance, she said, is her top issue.

“There are a lot of problems related to that insurance question,” said Powell, who said she votes mostly for Democrats. “Nothing I've seen from the current administration seems like it would have the slightest possibility of making things better.”

The only thing she’s heard state leaders like Landry and Temple doing is making it easier for insurers to drop policyholders, which she believes will only worsen the problem. Powell said she’d like to see leaders bolster the insurer of last resort, Citizens, into a viable safety net.

“My salary is not doubling every year,” Powell said, even though insurance premiums are.

Read next: Louisiana voters so far approve of Jeff Landry's politics, poll shows. Here's why.

Read next: Jeff Landry, Louisiana lawmakers went too far on permitless concealed carry, poll shows

How the poll was conducted

Faucheux Strategies, a nonpartisan research firm based in Louisiana, interviewed a representative sample of 800 registered voters across Louisiana between April 22-26.

Trained professionals conducted the interviews by telephone; 79% of them were contacted on cell phones and 21% on landlines.

The calls were based on a scientifically selected, random sample of state voters. The racial composition of the sample was 64% White, 30% Black and 6% other. For this poll, “independent” includes people who have no party affiliation and people who are affiliated with a third party. The poll’s margin of error is +/- 3.46%.